The Liquidity Vacuum

Policy makers, regulators and a small bank combine to suck air from the system

WHOOSH! That’s the sound of liquidity instantly sucked out of the financial system from margin calls. Forget about SVB; the lasting shock may turn out to be the margin hit to fixed income markets. Will it blow over? Unlikely. This is not just about a single medium-sized bank. This is about the configuration of the system. In addition to existing imposts, clearing houses plan to slap extra intra-day costs on the financial system from the end of March. To adjust the system will have to treat recent volatility as a lasting drain on liquidity. It is bound to restrain Fed policy for fear of adding fuel to the fire. Inflation will have to take a back seat to financial stability. These are the consequences of the absurd policy response to COVID and regulators who see stress only in terms of the last crisis. Our monetary guardians have created a liquidity vacuum and we’re wedged in a funnel from which there appears to be no escape - for them or for us.

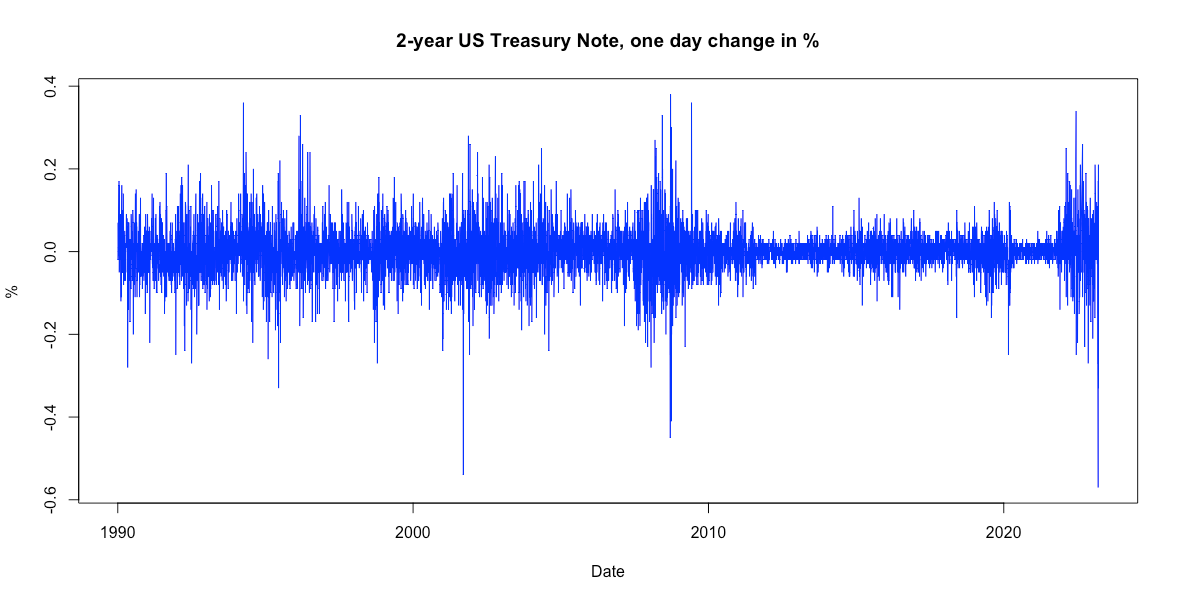

A quick tour of the eye-watering volatility of fixed income markets last week.

2-year Treasury bond yields moved nearly 60bps in a single day - the largest single daily movement recorded by the US Treasury since at least 1990.

Yield curve shape (2s10s) steepened by 40bps in a day - the largest daily move since at least 1990.

The BoA MOVE Index (a measure of the cost of insuring bond prices for a short period) moved in a similar magnitude to the day after Lehman Brothers bankruptcy.

Turnover in USD interest rate swaps totalled almost four times the usual level.

This adds up to massive, instantaneous liquidity drain of the financial system as margin calls are made by clearing houses. We’ve been wondering for months when the Fed will break something with its aggressive two-pronged tightening (rates + QT). Turns out it may be clearing houses that may threaten to tip over the boat. The proximate cause was the bankruptcy of SVB. But disturbance on this scale is designed into the architecture of finance by the ‘reforms’ that followed the GFC. The emergence of central clearing, to contain systematic stress will almost certainly made things worse when a sudden stop occurs. The Fed wrecking ball has been joined by the garotte of the margin call.

And it is frankly amazing to realise that the circumstances that led to this mayhem (very high inflation, inverted yield curve, sharply higher interest rates) do not figure in any of the stress tests performed on either side of the Atlantic. Regulators were unable to imagine this crisis could have happened.

There were obvious warning signs of impending danger. Last week’s market disturbance shows similarities to the UK’s September ‘LDI Crisis’ which also came out of the blue for regulators - though market participants had written to regulators years before warning of just such an event. The ‘LDI Crisis’ saw losses on government bonds lead to margin calls on pension funds that led to further bond sales to raise money, meaning further losses which led to further margin calls. The Bank of England had to step in to calm the spiral.

The Fed this week expanded its balance sheet by $297bn, taking the overall balance sheet size back to the same level as last November, and so reversing the efforts of QT. During the 2020 coronavirus-triggered “Dash-for-Cash” it is estimated that combined margin demands increased globally by up to $500bn. For fixed income markets the last week exceeded the shock of 2020 by some margin. It seems the scale of balance sheet expansion places the last week on a par with the March 2020 COVID shock.

The good news (so far) is this disturbance did not transmit into equities (much), and it may be that non-US fixed income markets avoided the massive margin calls that were certainly made in the world’s financial centre. But frankly it is too early to tell.

At present we know only that a couple of banks have gone. There are bound to be more casualties. Stories of the closure of leveraged asset managers are starting to emerge. There may be more to follow. Then there is the small matter of a tottering global investment bank to consider.

The shocking moves in fixed income markets mean clearing houses will remain wary of market volatility. In fact, clearing houses are preparing to impose more margin penalties. The DTCC's subsidiary, National Securities Clearing Corporation (NSCC) announced on Tuesday that from the end of March it will be able to call for extra margin intra-day for volatility in addition to intra-day calls for mark-to-market changes.

Weirdly, many conventional signals of financial stress remain preternaturally calm. Repo rates rose a couple of basis points, repo fails don’t seem to have increased. This may be because the Fed introduced measures such as the Standing Repurchase Facility to keep these symptoms of stress from erupting. It is worth considering if, by seeking to contain stress, the Fed’s innovations simply mask true stress. It is true the bank run that emerged on 9th March in California was unprecedented. Online deposit withdrawals removed $42bn of SVB liabilities in a single day. But the tension between deposit funding and money-market rates at the very short-end of the curve was a glaring anomaly for months. Well-known online commentators had been pointing to the discrepancy as a specific point of stress.

“How do you get to financial stability?”

“Don’t start from here!”

Great analysis Meyrick - ZH should report your work. I will add a link in a relevant comment. Readers may not appreciate the importance of Repo, which i was expecting to blow out. https://austrianpeter.substack.com/p/a-perfect-storm-the-money-crisis?s=w

As I had heard nothing from a friend here I assumed that the leaking gasoline hadn't reached their pit yet - give it time! https://repowatch.org/

And I find Doug Noland brilliant in his assessments: http://creditbubblebulletin.blogspot.com/2023/03/weekly-commentary-fire.html