Could QT reduce the liquidity premium of certain assets to such an extent that there’s a ‘sudden stop’ in market liquidity? This question has been a preoccupation since I persuaded myself a link existed between a/ the rising level of system reserves and b/ both the daily turnover of FedWire and the daily turnover of securities/repo in US capital markets. Sure, the link is not linear. But as QT progresses, it is important to ask how much elasticity exists in the settlement system dependent on FedWire and the turnover of securities markets. For if there is some unseen limit to that elasticity, it is possible that liquidity in securities may evaporate suddenly and with dramatic (negative) price consequences. I conclude that a sudden stop is possible.

There follow three not-wholly-convincing charts which lay out my thinking. Bear with me. As I said, the relationships are elastic, and they have also changed over time so conclusions are difficult to draw with certainty.

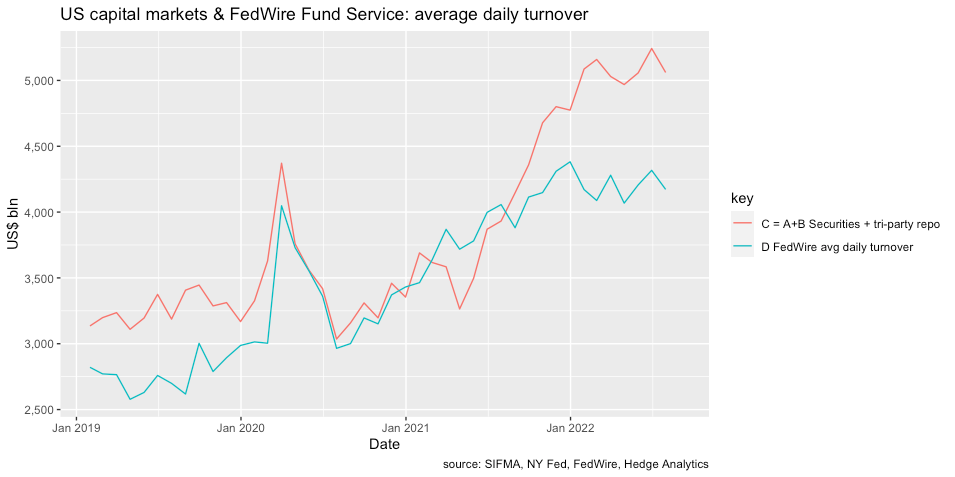

The first chart shows average daily turnover of:

all US securities (equities, Treasuries, agencies, municipal and corporate bonds, MBS, ABS)

Tri-party repo

Tri-party repo has become the dominant repurchase mechanism in US markets, processing by far the largest quantity of repo trades transacted by money market funds via the FedWire Fund service.

As such, the combination of securities turnover and Tri-party repo turnover collectively represent a high percentage of daily liquidity in US capital markets. The exact percentage is unclear. However, it is clear that a good part of US capital market liquidity is processed via FedWire Fund Services. It is also clear that Tri-party repo turnover has increased dramatically in the last 18 months. This may be important, so hold that thought.

The second chart shows the relationship between the combined Securities/Tri-party repo turnover compared to FedWire Fund Services turnover. As outlined above, the match is not exact, but we can assume a relationship exists. We know a large number of securities transactions are settled between banks and their customers through FedWire using central bank money (reserves) and the vast majority of money-market deposits in the Fed’s Reverse Repurchase Programme (RRP) use FedWire on to re-post daily. Indeed, the rise in RRP balances accounts for all of the very steep rise in use of Tri-party repo since March 2021.

The third chart shows the evolution of a/ FedWire Fund Services (ADV) and b/ System Reserves held at the Fed (stock).

This last chart shows a not-very-convincing relationship, but prompts the most important question. Let’s first address the not-very-convincing relationship then address that ‘most important question’.

The plot shows that daily turnover of FedWire (red line) may deviate considerably from the stock of medium in which that turnover is transacted (blue line, Fed System Reserves). In fact, this is no surprise, and reflects the concept of monetary velocity. This works with any stock and flow of money. An economy may grow with a static stock of money through an increase in the velocity of that money (the number of transactions each existing dollar performs in a given time). So the not-very convincing relationship is entirely explainable by adjustments in velocity of reserves in FedWire. The key takeaway is while there is clearly elasticity in that velocity, we don’t know what that elasticity is because of radical changes in the bank settlement pre and post-GFC.

As Tri-party repo transactions have increasingly dominated FedWire turnover the velocity of reserves used for other FedWire transactions must, by definition, have increased. Those other FedWire transactions are largely securities settlements. Which leads the the ‘most important question’ which is formed of two parts: what is the limit of that velocity and which securities will be most impacted by that limit?

We don’t know the answers, but already there are signs of reduced liquidity in equity market turnover. Partly that is the usual summer seasonal lull in trading. However, 2022 liquidity is significantly lower than a normal summer. Liquidity in other markets such as Treasuries, remains immune - though that does not mean it will remain that way.

But liquidity constraints never emerge slowly. There is usually a sudden stop when one party realises they cannot settle which promotes panic and sudden fears of settlement risk. We have not got there yet, but such a sudden stop needs to be considered. In the past we received signals of approaching liquidity limit through short-term interest rates. In particular, spreads between Fed Funds and short-term collateralised rates. Unfortunately, that signal is not guaranteed to work this time because the tremendous volume of cash deposited in RRP acts to suppress repo rates generally. If repo isn’t going to give provide the marker for liquidity’s limit where else in the system may the risk of ‘sudden stop’ emerge? My wild guess is settlement of equities.