“This gargantuan and growing appetite”

‘…more elegant cars, more exotic food, more erotic clothing, more elaborate entertainment – indeed… the entire range of sensuous, edifying, and lethal desires.’ J.K. Galbraith,

Previous posts on ExorbitantPrivilege identified some measures of dollar dominance: reserve holdings, international trade, and the US consumer ‘of last resort’. This short post looks again at the role of the consumer and how the US financial system creates the dollars demanded by the rest of the world. So, the two questions those arguing for a reduced role for the dollar need to answer are: will the US consume less in future, and will foreigners fund the US less? Only if the answer to both questions is ‘yes’ will the dollar find its ascendency thwarted. The recent evidence counts against a change in regime. The dollar’s performance against virtually every currency in the world, suggest Americans may be forced to consume foreign products. That requires foreigners to take on more dollar holdings. Hardly the sign of a loss of dollar dominance.

US stock valuation reflects the ascendent consumer

The structure of US stock market has reflected the importance of consumption for decades. In 1970 the top 10 companies by capitalization were IBM, AT&T, General Motors, Eastman Kodak, Exxon, Sears Roebuck, Texaco, Xerox, General Electric, Gulf Oil. The US and its stock market valued cars for consumers, fuel for those cars and counting machines to measure consumption.

Today’s largest U.S. companies by capitalization continue to focus on consumer goods and services. The highest ranked company not primarily oriented to consumption (broadly defined) is Raytheon Technologies, at number 50. The key difference to 1970 is that now a good part of consumption is digital; cars and energy have been relegated.

Top 10 US domiciled companies by capitalization, 2022

Borrowing to consume

As US consumption has reliably outstripped local supply, trade deficits have become a way of life. In return, both the U.S. consumer and the U.S. capital markets are sustained either by selling their assets to foreigners or borrowing from foreigners.

US debt as % of GDP, by category

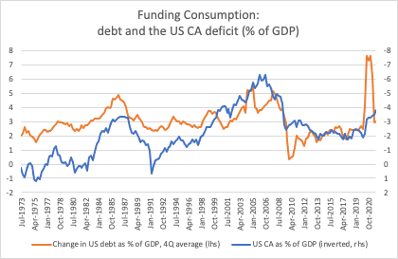

The US current account deficit has become a measure of the country’s economic appetite. The current account deficit has been rising again since 2020. Debt has been the crucial source of funding. Over the last 50 years every category of debt in the U.S. has risen. In the aftermath of the Ukrainian invasion, the evolution of the US current account may determine whether the rest of the world suffers a depression or just a nasty recession.

US current account and debt

If the private sector won’t borrow, the government will

The US financial system orients its savings and investment the sustaining consumption, including the Federal Reserve, the Federal deficit and by extension, the dollar itself. If the US private sector cannot or will not issue more debt to fund the nation’s consumption, then the federal government takes over the role, as it has since 2009.

Free to choose

J.K. Galbraith worried about American “production and consumption habits." He also decried the link between consumption and liberty; “It is … suggested that uninhibited consumption has something to do with individual liberty… I shall not dwell long on this. … Freedom is not much concerned with tail fins or even with automobiles. “

It is no longer tail fins Americans are concerned with, but smart phones, mostly produced by foreigners. Galbraith could never have imagined that smart phones indeed have become a symbol of individual liberty, in ways even cars never did.

Perhaps more important than liberty, the international trade system continues to suit both individual Americans and foreigners. Foreign exporters who choose to rely on the US consumer are “locked into structural domestic demand deficiencies1” which require access to the United States financial assets, often bonds, to absorb their savings.

This policy choice is made willingly by China, Germany, and Japan even though the surpluses these countries create reduce consumption for their own citizens just as they boost the consumption of the United States. Conversely, their savings fund the US indebtedness created by this system, creating demand for dollars.

“But what of the appetite itself? Surely this is the ultimate source of the problem. If it continues its geometric course, will it not one day have to be restrained?”

A system that relies on ever-growing debt may not be sustainable in the long run. But a decision to change seems more likely to be made by the United States than by mercantilist economies. Foreigners don’t have any choice but to support the dollar system while their own economies rely on the US consumer. If the dollar does lose its allure, it will be because America deems it is in its own interest.

There is no disturbance in the force

In the meantime, this arrangement underpins the world’s capital markets. The more important drivers of financial conditions globally are (in order of importance): US equities, US bonds, then foreign equities/bonds and currencies/commodities. All are founded on US consumption.

The underlying structure of this financial universe have been remarkably stable for a prolonged time, even if price levels of assets have varied massively. The following chart shows the contribution of the top five principal components to a representative financial universe of equities, bonds, spreads, commodities, and major currency pairs over the last 20 years. Together these five components explain, on average, about 90 percent of the change across the entire system. Yes, individual markets may rise and fall, but the factors behind them have remain broadly consistent. There is no sign of any major disruption in the system. It remains coherent, and despite the efforts of regulators and government, largely self-organizing. And the fundamental anchor is the dollar.

Main drivers of financial universe

No threat in sight

Reserves, trade invoicing, consumption by the US, the openness and coherence of dollar markets; which of these is the most important support to the dollar as the global currency? Well, it ain’t reserves. Dollar reserves come from the general acceptance of the currency in international trade and the need to balance savings between countries. The need continuing acceptance of the currency in trade is ultimately dependent on the US consumer supporting the mercantilist policies of Europe, Japan, China, and other regions. If those regions are not able permanently to fix their imbalance in trade and investment, the dollar is going to remain ascendent.

Changing the Top Global Currency Means Changing the Patterns of Global Trade, Michael Pettis, https://carnegieendowment.org/chinafinancialmarkets/86878