Yes, I’m as bearish as the rest of the market. All of us seem to hate the current risk rally. Vocal bears have latched onto the highly unusual year-on-year fall in money stock (M2) in the US, as a signal of an impending (and savage) market, downturn. But a word of caution. Liquidity is internationally fungible. Yes, even with China - just look at their current account surplus. Though M2 is falling in the US, the nominal value of the dollar has also declined, boosting the liquidity available from non-dollar currencies. The value of the dollar is the main swing variable for available global liquidity which is so important for risky assets. That may not save the US from a recession, but it may mean US stocks outperform what appear to be universal low expectations. We’ll see.

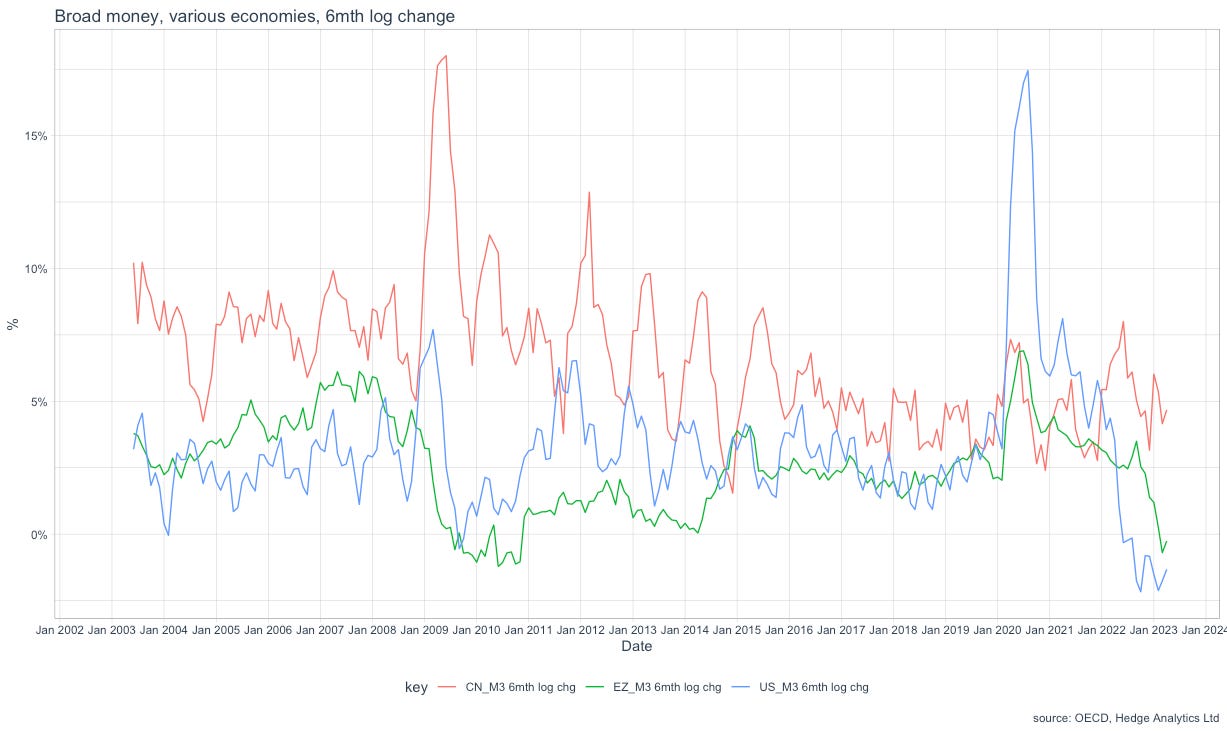

This is what M3, as reported by the OECD, looks like for the three major stores of money (US, Eurozone, China) in local terms.

Both US and Eurozone show negative growth rates as a log 6-month change. But adjust for the recent fall in the dollar and you get a very different picture. Liquidity in US$ terms is expanding fast in China and Eurozone, at least by this measure.

Add together broad money for all major advanced economies (including the US) in US dollar terms and the picture is clearer still.

That is important because Global broad money denominated in dollars has a clear though bumpy relationship with the performance of the S&P500, as does the value of the dollar internationally.