The level of the dollar makes a huge difference to the liquidity of capital markets. A rise in interest rates by the Fed may crimp the spending of Main Street, but if it is accompanied by a fall in the dollar, capital markets may shrug off the higher cost of funding, because more dollar funds become available by the lower dollar. I suspect the recent fall in the dollar is a big reason why US equity markets remain supported. It has bolstered broad money denominated in dollars.

A couple of interesting charts to bolster the case.

The first shows the correlations of lead/lag of S&P500 to broad money of top economies converted into dollars for the last 20 years. It peaks at ~40% correlation between change in S&P500 & change in global money growth.

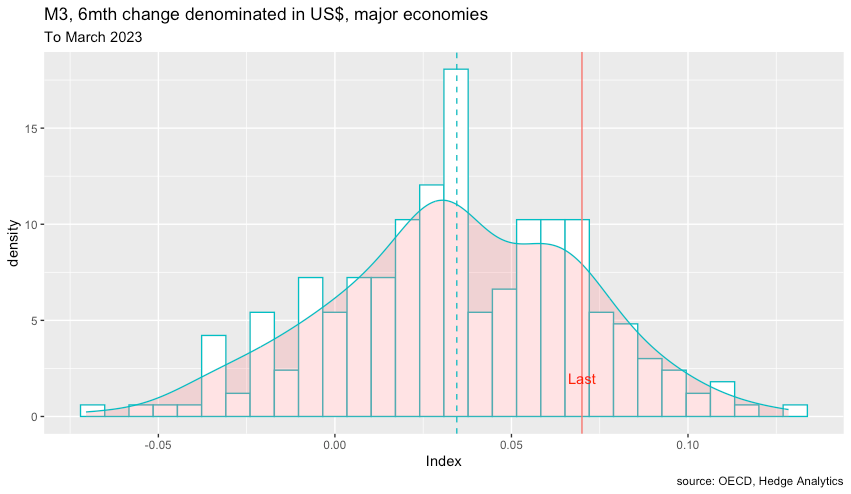

The second shows the density of 6-month changes in broad money over the same 20 year period, and I highlighted the latest point we have (March 2023), showing it is way to the right of the mean (dotted line), meaning global broad money in US$ is plentiful.