I could learn to love the dollar, if given enough of them

Weaker dollar gave risky assets a boost, but the pick-me-up effect is fading

It has been raining for a whole month, metaphorically, in funding markets. The US 2-year Treasury yield approached 5 percent, forcing the yield curve to invert to the greatest extent since 1981. Doomster tourists dusted off their trusty ‘yield curve prognosis’ to tell us, in unison, that recession must be round the corner. Numerous reports suggested the Fed and the ECB will hold interest rates higher for longer - not surprising given the monetary overhang. With such a background of economic and funding gloom you’d be forgiven for expecting risky assets to be in full retreat. Yet major stock markets have held their 2023 gains. What’s going on? Well, it’s all about the dollar, which fell 5% in the last 4 months, boosting global liquidity.

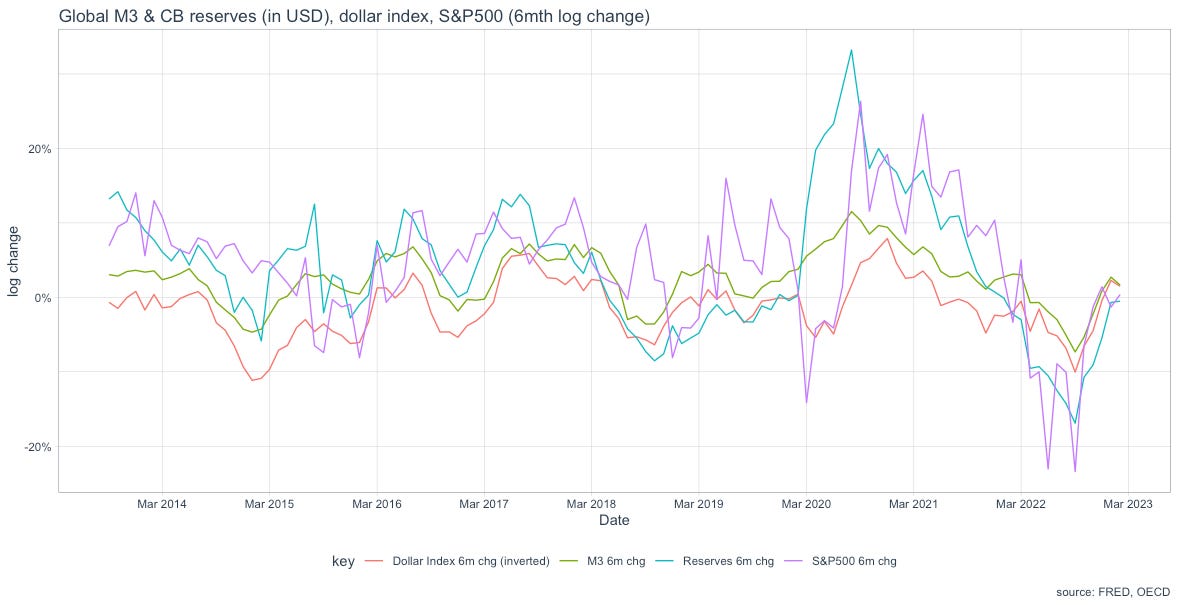

Here is a graph showing the log 6 monthly change of a broad nominal dollar index, a couple of monetary measures (global M3 & major central bank reserves, both denominated in USD) and S&P500. The link is clear and long-running. Since early November the nominal value of the dollar against a range of currencies declined and the stock of global liquidity in dollar terms rose. This has underpinned demand for risky assets, till now.

Unfortunately, the dollar-inspired updraft to equities won’t last. The dollar turned higher in the last month, boosted by worries that Jerome Powell and company will keep rates higher for longer. And signs of funding difficulty have re-appeared elsewhere. The ECB has expressed concern that rates will have to move higher again, and remain high. The Chinese Total Social Financing impulse appears to have turned down at the beginning of the year after a big boost in 2022. It looks like the stormy weather that has afflicted rates markets recently may cast a gloom over equity markets in the second quarter of 2023.