The Fed like everyone else, wants to talk about the bond market. In the last week at least 4 current members of the FOMC made direct reference to bond yields and market functioning, in concerned tones. But bond yields are just one liquidity constraining factor. QT continues everywhere. Moreover, no-one at the Fed likes to talk about how their policy has an obvious feedback loop into global conditions, but it can’t be ignored. Fed policy is emulated worldwide. More directly, the dollar acts as a liquidity regulator. The broad dollar index is back to levels seen in October last year.

Each of the 4 FOMC member talking about bonds provided details in their recent comments that are illuminating. And each, in their way, reflect on the way that policy’s ‘long and variable lags’ may be entering the system. That process has a way to go yet, though, and the path isn’t likely to be altogether smooth, particularly as the dollar works its constraining effects throughout the global financial system.

Here are the four comments, which I’d then like to consider briefly.

Jefferson: “…financial conditions have tightened further, and real long-term Treasury yields have risen significantly.”

Logan: “If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate…"

Waller: “The financial markets are tightening up and they are going to do some of the work for us...We are just keeping a very close eye on that. We will see how those higher rates feed into what we do on policy in the coming months."

Bowman: “It will be important to watch for signs of impaired Treasury market functioning, especially as the Federal Reserve continues to reduce its holdings of Treasury securities and Treasury auction volumes expand to meet issuance needs.”

All four comments seem domestically focussed. Philip Jefferson talks about 'real long-term’ yields, which has the advantage of imprecision - always handy. It isn’t clear which real yields he’s looking at. If he is using the measure calculated by the Cleveland Fed, then real yields are well over 30 basis points lower at the end of September than they were in March 2023. Presumably, if this is so, inflation is now under better control than in March for Jefferson. From which I conclude that professor Jefferson’s reference may reflect a downgrade in the need to raise real rates.

Lorie Logan’s comments do talk about nominal yields, and term premium. I admire Ms. Logan for her experience of Open Market operations at the New York Fed, among other reasons.

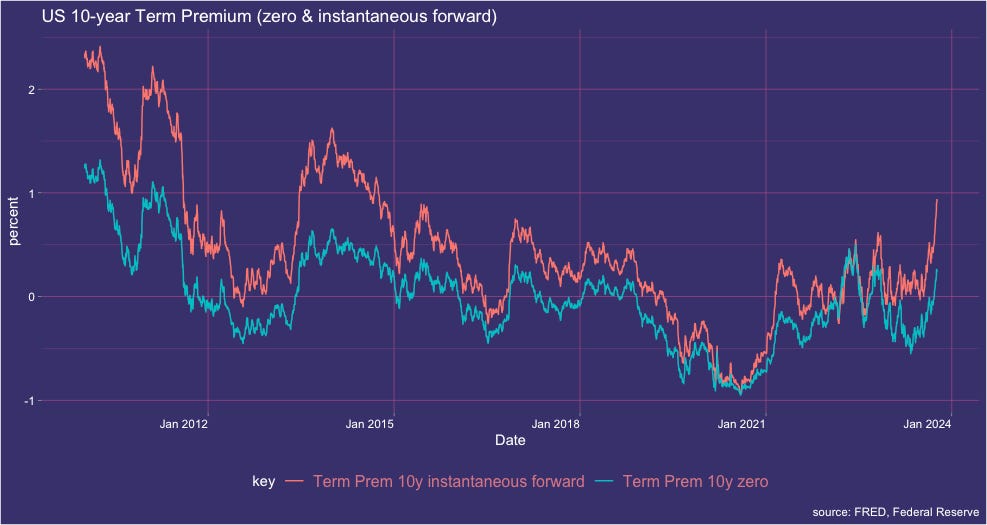

I get confused when people refer to term premium, because no-one is quite sure what it is reflects. The Fed itself seems confused. It publishes at least two versions of term premium. While both have risen sharply each is giving different information. The instantaneous forward measure is much higher than recent history, the zero-coupon based measure overall lower, and more-or-less equal to levels of October 2022. Which is right? Probably neither.

Perhaps Ms. Logan is actually concerned about yields, rather than term premium. In fact, I conclude that her concern is for both the outright level of long-term Treasury yields plus the recent re-steepening of the yield curve, which highlights the recent idiosyncratic behaviour of long-term rates and has widespread economic and fiscal costs. The governor of the Dallas Fed suggestion that short rates may not need to move if long rates are doing the tightening may be aiming to contain recent moves. In a way a current iteration of ‘forward guidance’. It seems in line with professor Jefferson’s stance.

For reasons that aren’t clear, I can’t access the text of Christopher Waller’s interview with ex-Speaker Ryan on the Fed’s website. So, I rely on reports of what he said. Which may be summed up by his comment that “we're in this position where we kind of watch and see what happens on rates” (courtesy of tightening financial conditions due to rising bond yields, my words not his). Again in line with Jefferson and Logan.

His comments on tightening financial conditions (a reference to bond yields) makes me wonder if Christopher Waller also may change his mind about available liquidity. In January he said “you should be able to take $2 trillion (of reserves) out an nobody will miss it.” We are $1 trillion (reserves + ONRRP) lower today than when he spoke and I struggle to imagine we going to reach his $2 trillion mark.

Ms Bowman continues a growing theme of concern about possible impaired functioning of the Treasury market, which is perhaps the only one of the four which implicitly considers international capital flows - in this case into, or out of, Treasuries.

As I said, no-one at the Fed likes to talk about is how their policy impacts global conditions, but it can’t be waved away. The rise in the dollar drains global liquidity at a time when the Fed and other central banks continue to drain liquidity. After a short-term spike in reserves following the bankruptcy of SVB, the 6 month change in combined central bank liquidity in USD has now turned clearly negative again.

At a global level, the dollar denomination of money and liquidity is always worth considering - which is why this blog is called ‘Exorbitant Privilege’. The recent rise in the dollar will reduce international deployable capital. A rough-and-ready proxy is the broad money of major economies, expressed in dollars, which has gone negative again after rising from late 2022.

I’m not convinced this will lead to the same deterioration in risk assets as last year; rollover of funding is not yet a pressing issue. A Vector Autoregression projection of dollar, S&P500, and broad money suggests further upward movement in the dollar over the next 6 months, and basically sideways movement in equities. Not terrible, but not something I’d hang my investing hat upon. Still, it doesn’t seem a great time to look for risk outperformance.

it seems to be a circular problem as the higher rates add to the dollar's strength and the dollar's strength reduces liquidity and drives yields higher. having been involved in FX markets for > 40 years, i have seen this movie before in the mid-1980's leading to Louvre and Plaza agreements. I suspect we may see similar issues yet again