Dangerous curves

The renminbi and yield curve may signal a new era of permanently higher funding cost.

US yields, curve and renminbi are current macro hot topics and likely to remain so. Already the implications have begun to permeate risk assets, undermining their remarkable resilience to monetary tightening. If the steepening continues, maybe we’ll finally find the limits of that resilience. What is happening to the renminbi may be a lesson of what a steeper yield curve really entails - permanently higher funding costs for everyone. The renminbi may be a lead indicator of what to expect in other assets.

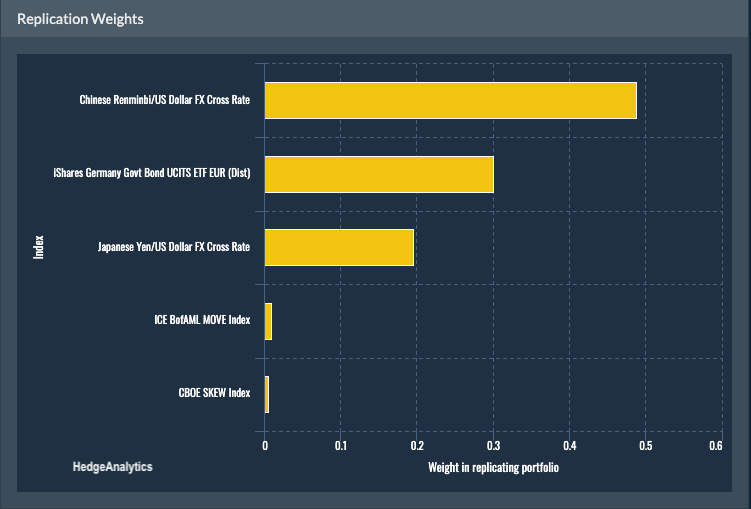

The Chinese currency is intimately linked to the performance of Treasuries. It has been for years. As I noted on June 15 “the principal currency axis in the world remains the dollar/renminbi. And… currency behaviour, especially renminbi, continues to reflect US debt market dynamics.” The reason for the relationship has little to do with reserve acquisition and a lot to do with relative funding cost limits in the US and Chinese economies (who is more efficient). As a result, the renminbi is an important hedging component for Treasuries, with a weight of ~50% in my (parsimonious) hedging basket.

Some now claim that rising Treasury yields reflect a growing fear of Chinese currency intervention. Yes, there’s a link between renminbi devaluation and higher yields. The causality, though, runs from Treasuries to Chinese currency.

For instance, the downward trend in CNYUSD began as the Fed began to tighten rates in March 2022 and Treasury yields began to rise. The intervention argument has little serious plausibility unless it helps Chinese macro environment. It doesn’t. Which hardly guarantees Chinese authorities won’t intervene, but they surely realise it’s logical to see a lower renminbi as Treasury yields move higher on relative outperformance of the US economy.

The parlous Chinese economy requires monetary easing - exactly the opposite policy remedy to the US. That’s why reserve requirements for Chinese banks may be eased for the third time in 12 months this month. With divergent policy, a currency decline is an entirely natural result. If Chinese authorities intervened to support the currency, they may actively undermine their economy further and counter the effects of their easing measures. It looks more likely Treasury bear steepening is having an effect on the renminbi than the other way around.

So what ails the Treasury market? Two things: declining probability of a Fed ‘pivot’ and growing duration risk.

Growing duration risk in the Treasury market is also probably a most important recent additional factor. The duration of future Treasury issuance is likely to rise, possibly significantly and pre-emption of additional duration is probably behind at least some of the recent curve steepening. This is independent of recent rating assessments, though these have certainly drawn attention to the fiscal imbalances of the US government.

Moreover, since QE ended in March 2022, Treasury investors have benefitted from an overall fall in issued duration, that seems unlikely to continue. If the trend reverses, it is logical to expect long yields to rise.

Indeed, there may be early signs of more duration entering the market at longer maturities. Since the Debt-ceiling resolution in June, the composition of coupon issuance has concentrated duration in the 10-year and 30-year points, even before coupon issuance has ramped up.

The US investment community and economy appears to be getting used to the idea that high Fed rates are here to stay. This is reflected in the diminishing influence of Fed target rate on the yield curve. Or, to put it another way: the yield curve is increasingly linked to the wider economic and investment universe and less driven solely by short-end changes. That marks a noticeable change. For a year from March 2022 the dominant driver of the yield curve was the upward move in Fed Funds, with every 100bps of Fed rate rises leading to ~20bps of curve flattening/inversion. The administered rate (Fed Funds) was by far the largest driver of yield curve dynamics. Why? Longer-dated yields became somewhat constrained by an assumed monetary ‘pivot’ which assumed the Fed would not need to keep rates at current levels for long. That appears increasingly to be a minority view.

The bankruptcy of SVB disrupted that relationship. Even though the first reaction to SVB’s filing revealed increased confidence in the ‘pivot’, the months that followed saw confidence in a policy turn ebb (including by me). All the time the holding-cost of bonds have risen.

This ‘re-attachment’ effect of the yield curve is seen by measuring its co-variance with non-administered financial markets - namely how equities, currencies, and commodities but NOT Fed Funds are impacting the yield curve.

Before the Fed began tightening, the yield curve showed high response to the wider financial universe. As Fed Funds rates rose, that influence declined progressively, culminating in almost no influence of wider markets on the yield curve at end-2022 - this represented peak ‘pivot expectations’. After the SVB bankruptcy filing failed to deliver the expected ‘pivot’ the wider financial universe made a dramatic reappearance as a factor determining variance in the yield curve.

A rise in response of yield curve to wider financial markets is naturally accompanied by a rise in response of wider financial markets to the yield curve. That will be especially true if the yield curve continues its bear steepening. Some have pointed to the bear steepening as explanation for equities recent move down. Others point to China as the explanation for equities recent struggles. But as we saw above, China, as reflected in the renminbi, is closely associated with developments in the Treasury market and relative economic prospects. And that may be the important takeaway.

What the curve seems to be telling us is US funding costs appear set to remain durably higher than expected. It may now be the turn of Treasury curve to ‘pivot’ as chances of a monetary ‘pivot’ decline. Monetary developments famously emerge with ‘long and variable lags’. Part of what has kept financial markets, including currencies like the renminbi, relatively calm over these months has been a belief in the transitory nature of higher funding costs. That is what the steeply inverted yield curve told us. If this belief is undermined, expect readjustment across a spectrum of asset classes. In that sense, the renminbi may be acting as a harbinger of what is to come for other assets.

Meyrick, Love the explanation and agree wholeheartedly. I cannot get away from the feeling that this bear steeper is going to see 10yr and beyond yields rise sufficiently to climb above Fed funds, arguably a first for this move. But as you conclude, we will see some significant repricing in risk assets, notably stocks, but also EMG currencies I imagine with CNY at the top of the list. also, MXN, which has performed admirably during the past year may find itself under pressure in my view.