Svetlana Kirilenko: “You have everything! And still you complain. You lie in couches, and bitch to a psychiatrist. You’ve got too much time to think about yourselves.”

We all love a good bad-news story. It’s what supports Twitter and most of main-stream media. In my professional world I know that worrying about what is wrong, or might soon be wrong is the mainstay of fixed income analysis. And much of the time the conclusion is right. Things go wrong all the time. And yet…

And yet, we (mostly) live to tell the tale - at least for now. Which illustrates a near-constant in economies. Things go wrong, sometimes badly wrong, but despite the dire judgements and past performance, humans just refuse to stop buying stuff, or selling it. And out of economic rubble something appears to replace the dead stuff. Which isn’t to say things don’t trend worse; just that dire predictions can miss things. And over-interpreting time-series defined by bad news may obscure a less gloomy message carried by different series.

A recent minor eruption on FinTwit prompted these thoughts. A series which appears to have originated from Standard and Poors (though that is not the attribution in the tweet, so I may be wrong) shows a big spike in Chapter 11 filings in recent weeks for large(ish) companies. Further discussion pointed to higher rates and difficulties in accessing funding - aka ‘monetary tightening’. The conclusion was ‘why aren’t corporate spreads widening?’ Here is an anonymised version of the chart in question which appeared in various guises in the last week.

As regular readers know, I like nothing better than pointing to policy mishaps. But I’m vaguely aware that my bias sometimes need correction. So, I set out to see if things really were ‘almost-as-bad-as-2009-and-2020’ in Chapter11-land.

The answer is it depends who you ask, and it depends on how you ask the question. First off, I asked the American Bankruptcy Institute and their numbers (for all corporations, not just big ones) show 2009 as a huge spike in Chapter 11 filings; much bigger than 2020. Recent Chapter 11 filings have risen sharply, even exceeding 2020 numbers. But we are far from 2009 levels. So, total Chapter 11 filings paint a different picture to large corporate filings.

Which prompted me to look at insolvencies in the UK for some ‘macro-triangulation’. In the UK insolvencies look almost as bad as 2009, and much worse than 2020.

There are significant definitional differences between Chapter 11 and British insolvency as well as in the macro-environment in the two countries. But in both cases, I was struck by how low the number of insolvencies/Chapter 11 filings were recorded in 2020.

It is common knowledge that fiscal support during COVID pandemic gave rise to perhaps the greatest concentration of fraud in modern times in both countries. So great was the fraud that it will probably never be properly quantified. If the fiscal and monetary support dampened Chapter 11 filings and British insolvencies - which seems to be a reasonable conclusion - then much of that would show up as new business formation.

Yet surprisingly, to me, the trend shows no signs of reversing in either country yet, although the profligate policy support is long gone.

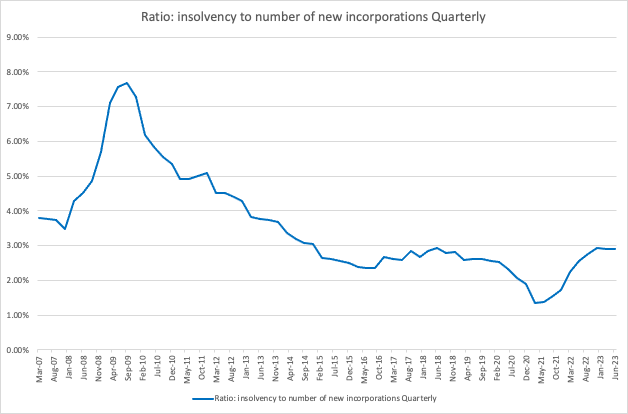

So, maybe a corrective to the first chart above would be to look at the ratio of Chapter 11 (or insolvencies in the UK) to New Business Applications (or new incorporations in the UK). As a measure it is not perfect - measuring different ends of the business landscape is time inconsistent, among other problems. But it does tell you something about the overall business landscape against which we should measure business woe. And boy, does is the picture different picture to the one given by the raw Chapter 11 figures.

Here’s the US:

And here is the UK:

Again, I wouldn’t claim this is a full picture. After all, if corporations are not feeling pressure, the Fed hasn’t properly tightened monetary policy. But it does throw quite a different light on the current stress. And it might also reflect a long-running effect of massive policy stimulation in 2020-2021.

If I remember correclty Mike Green mentioned the new tax requirements demand many more gig workers file for EIN and may be counted as "new businesses". I wonder if that may skew the results.

Excellent analysis Meyrick, thank you. The broader implications are even more worrying. My colleague in Australia writes an Editorial each week and I re-post on Tuesdays: Thoughts?

https://austrianpeter.substack.com/p/gold-backed-currency-redux-no-brics?utm_source=twitter&sd=pf